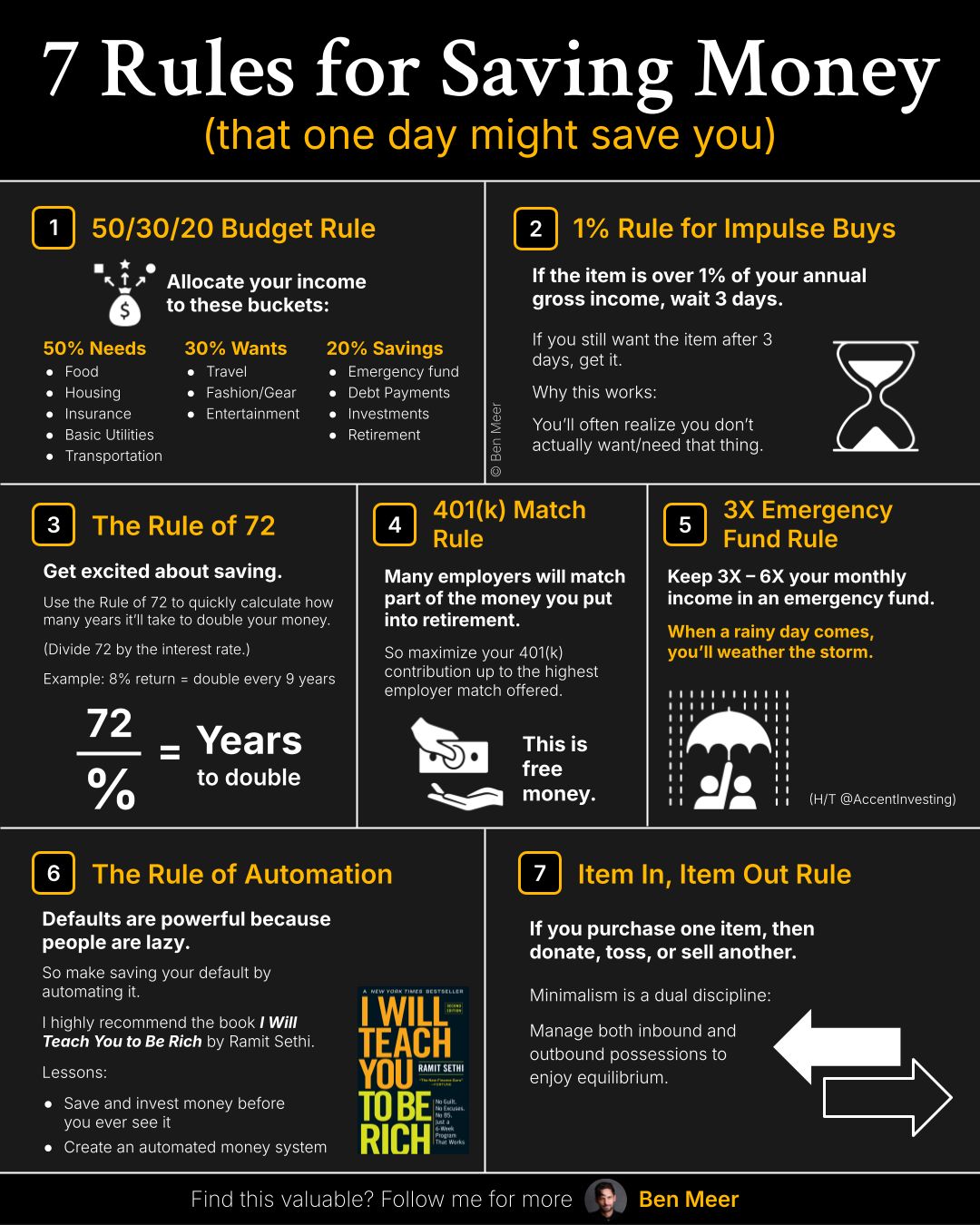

1. 50/30/20 Budget Rule

↳ Split your income wisely: 50% for essentials, 30% for desires, and 20% for savings.

↳ This balance keeps you grounded while leaving room for growth.

2. 1% Rule for Impulse Buys

↳ Wait 3 days if you want to buy something greater than 1% of your yearly earnings.

↳ This cooling-off period helps you avoid buyer’s remorse.

3. The Rule of 72

↳ Calculate how fast your money grows by dividing 72 by your interest rate.

↳ Knowing how fast your money doubles will motivate you to save more.

4. 401(k) Match Rule

↳ Take advantage of your employer’s retirement match (it’s free money).

↳ Every dollar matched is a step closer to financial freedom.

5. 3X Emergency Fund Rule

↳ Stash away 3 to 6 times your monthly expenses for unexpected events.

↳ This safety net ensures you’re ready for any surprises.

6. The Rule of Automation

↳ Set up automatic transfers from checking to savings accounts.

↳ Effortless savings lead to automatic money growth.

7. Item In, Item Out Rule

↳ Buy something new? Let go of something old.

↳ This minimalist approach keeps your finances (and spaces) in harmony.

What’s your favorite money-saving tip?

7 Rules for Saving Money